Add / Remove Partner in LLP

What is LLP and when can a partner be Added / Removed?

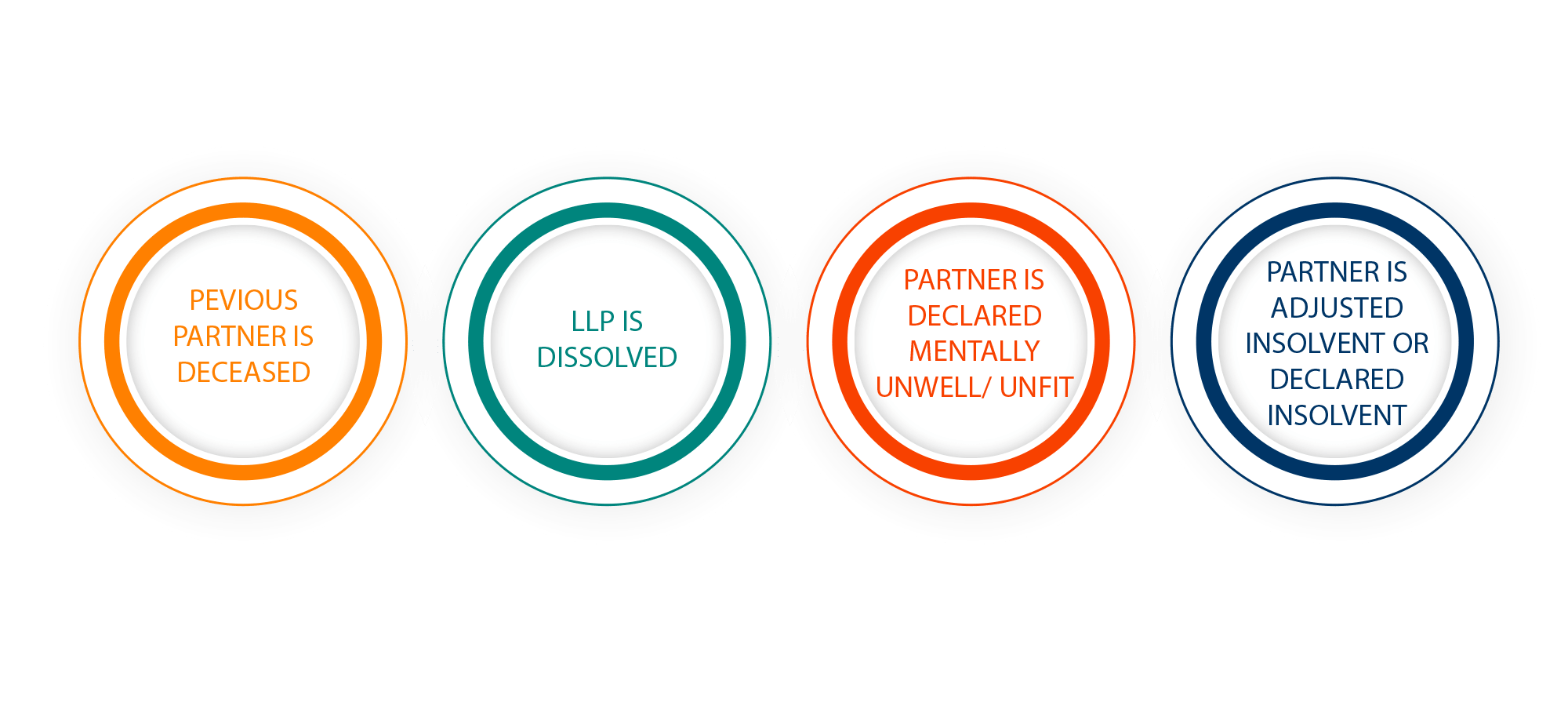

In any of the mentioned cases a partner can only be removed/ added when the existing partner has given any written notification of termination of partnership or when a notice is given to Registrar.

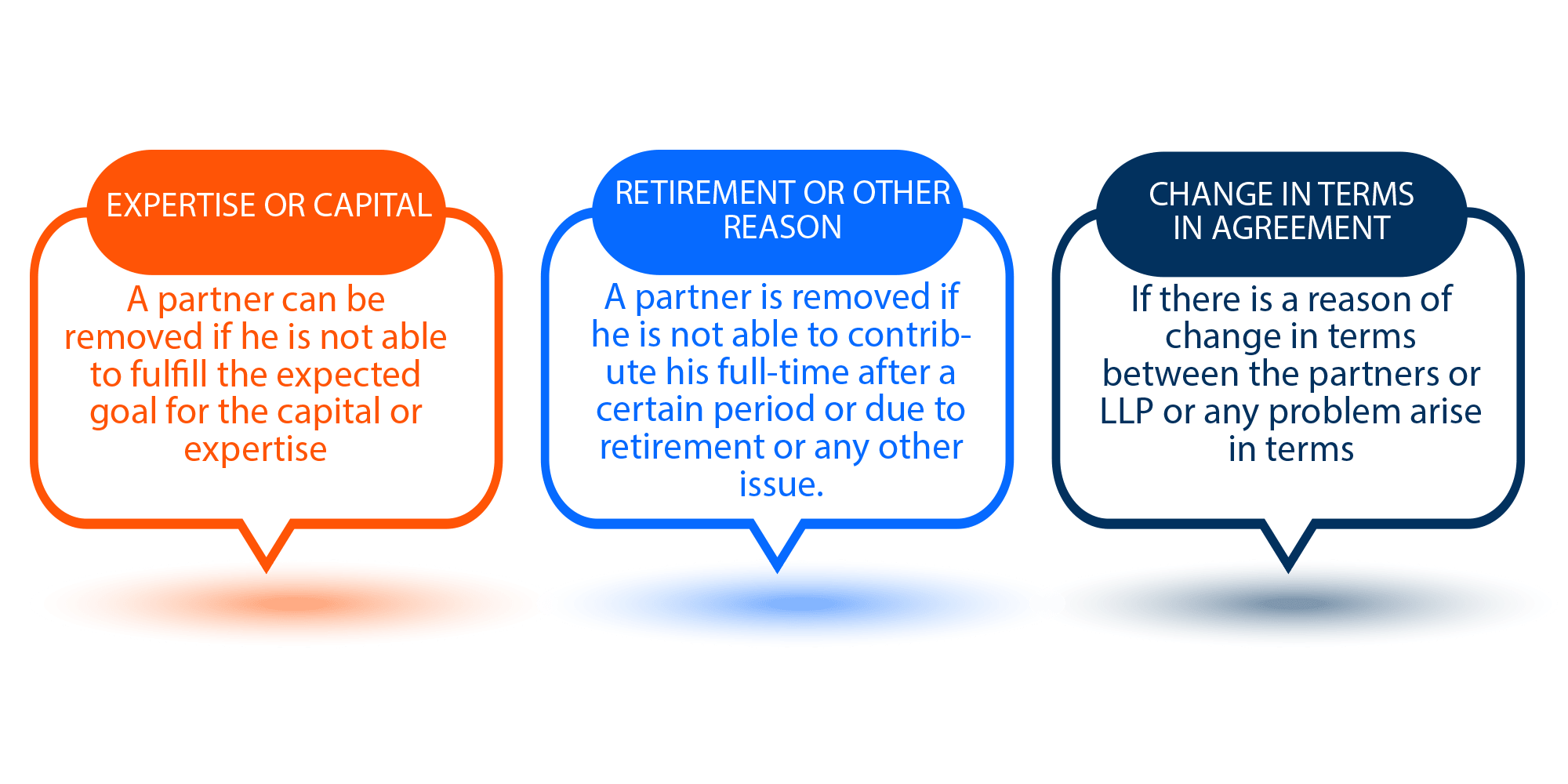

Reason to add/ remove partner can also arise when

In LLP a partner cannot be removed under majority unless LLP agreement provides such powers. If LLP in any case provides such powers, then the partner can be removed and form-4 must be filled to affect the removal.

LLP Form-4

LLP for 4 is filed when any change in the LLP partnership is to be done. LLP Form-4 must be filed if any partner needs to be resigned or removed or ceased. Form-4 must be signed by a designated partner of LLP and filed along with the certificate from a practicing Chartered Accountant / Company Secretary or Cost and Management Accountant. The practicing professional must verify all the details and must certify that all the LLP books and records have been found to be true and correct.

When a partner is changed into a designated partner or vice versa

Change is designation of partner does not include addition or removal of any partner/s it only includes changing the designation of partners. When an LLP is formed some people are gives title as a designated partner that holds the rights that are same for the director in a Private Company.

The change in designation of partner follows the same procedure as add/ remove of partners.

When the application is filed for change in designation, the concerned partner gets the DIN. If the person had already applied then he gets the same DIN and is added as a Partner/ Designated partner in LLP. In case of resignation/ removal of Partners/ Designated Partners, the concerned person needs to send a notice to LLP within a period of 30 days.

Steps to follow for change in position of Partner to Designated Partner / Add Designated Partner

Pass The Resolution:

To make any changes in the LLP, resolution is passed by the partners during the meeting as per the requirement of LLP agreement. This resolution will authorize any at present Designated Partner to work on behalf of LLP and its partners and shall also hold a valid DSC to file the application to the Registrar.

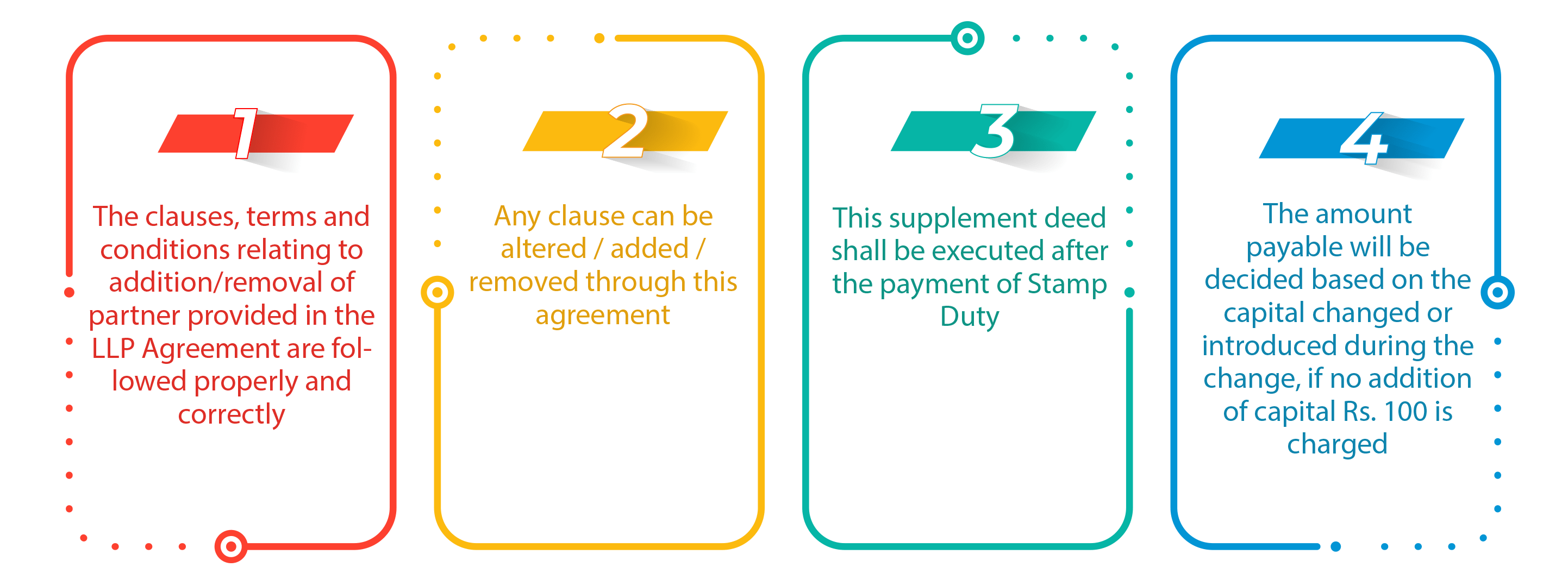

Execute Supplement Agreement:

This deed shall be executed by the partners, including the partner to be added/ removed:

File an Application for Approval of change:

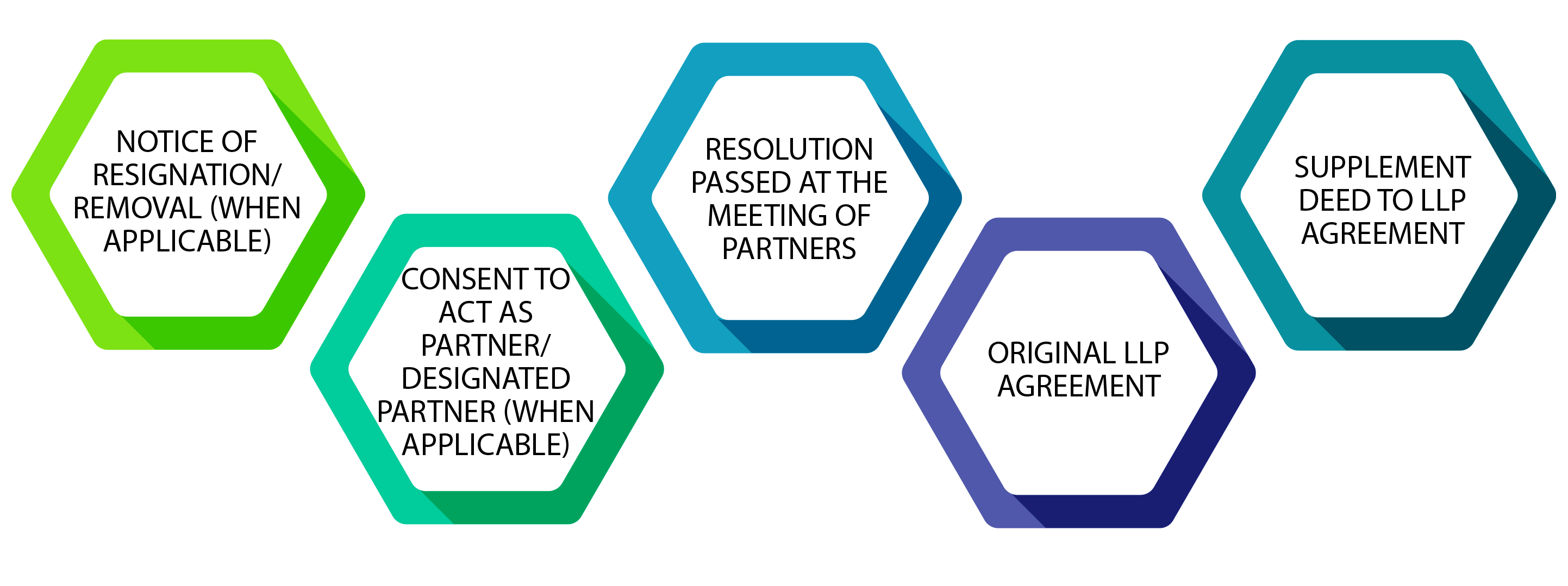

As soon as Supplement Agreement is executed for the change of Partner or Designation of Partner, LLP Form-3 & LLP Form-4 must be filled with MCA by a practicing professional i.e., Chartered Accountant / Company Secretary / Cost and Management Accountant.

Following Documents are required while filing the form

The Application for Approval must be filed within 30 days of the effective date of change or execution of agreement whichever date falls first. A late fee of Rs. 100 per day will be charged if application is not filed within the due date. The application will be reviewed and verified by the Registrar and will be approved on the satisfaction of the Registrar. Changes could be done in the agreement once it is approved.

FAQs

- LLP is an alternative corporate business form that gives the benefits of limited liability of a company and the flexibility of a partnership.

- The LLP can continue its existence irrespective of changes in partners. It is capable of entering into contracts and holding property in its own name.

- The LLP is a separate legal entity, is liable to the full extent of its assets but liability of the partners is limited to their agreed contribution in the LLP.

- Further, no partner is liable on account of the independent or un-authorized actions of other partners, thus individual partners are shielded from joint liability created by another partner’s wrongful business decisions or misconduct.

- Mutual rights and duties of the partners within a LLP are governed by an agreement between the partners or between the partners and the LLP as the case may be. The LLP, however, is not relieved of the liability for its other obligations as a separate entity.

Since LLP contains elements of both ‘a corporate structure’ as well as ‘a partnership firm structure’ LLP is called a hybrid between a company and a partnership.

LLP form is a form of business model which:

(i) is organized and operates on the basis of an agreement.

(ii) provides flexibility without imposing detailed legal and procedural requirements

(iii) enables professional/technical expertise and initiative to combine with financial risk-taking capacity in an innovative and efficient manner

- Under “traditional partnership firm”, every partner is liable, jointly with all the other partners and also severally for all acts of the firm done while he is a partner.

- Under LLP structure, liability of the partner is limited to his agreed contribution. Further, no partner is liable on account of the independent or un-authorized acts of other partners, thus allowing individual partners to be shielded from joint liability created by another partner’s wrongful acts or misconduct

- A basic difference between an LLP and a joint stock company lies in that the internal governance structure of a company is regulated by statute (i.e. Companies Act, 1956) whereas for an LLP it would be by a contractual agreement between partners.

- The management-ownership divide inherent in a company is not there in a limited liability partnership.

- LLP will have more flexibility as compared to a company.

- LLP will have lesser compliance requirements as compared to a company.